The United Arab Emirates (UAE) has solidified its position as a premier global investment hub, thanks to its strategic location, resilient economy, and diversified sectors that attract investors from around the globe. With a GDP reaching an impressive US$415 billion (Dh1.83 trillion) in recent years, the UAE ranks as the second-largest economy in the Middle East. This economic prowess has fostered a robust investment environment, making it essential for investors—both seasoned and new—to identify the top Asset Management Companies in the UAE to manage and grow their portfolios.

Here, we delve into the top-performing investment and asset management companies in the UAE, highlighting their unique strengths, service offerings, and the factors that distinguish them in this competitive landscape.

Nominate Your Company for the Cosmopolitan The Daily Business Awards!

Does your business deserve global recognition? Nominate now for the Cosmopolitan The Daily Business Awards and celebrate your achievements in innovation, creativity, and impact. This award is open to companies of all sizes and regions, from local innovators to global leaders. Stand out in your industry and showcase your success.

Top 9 Investment and Asset Management Companies in the UAE

1. Rama Vision Investments

Best for AI-Powered Investment Management

Rama Vision Investments is one of the premier asset management companies in the UAE, distinguished by its innovative, AI-driven approach to asset management. By leveraging advanced artificial intelligence technology, the company crafts sophisticated investment strategies designed to provide stable returns. With an average monthly ROI of 2%, Rama Vision Investments combines the efficiency of automation with expert human insights, offering investors a balanced and highly effective portfolio management experience.

- Minimum Investment: Starting at 100,000 USD (1 unit).

- Key Features:

- Multiple investment plans tailored to different risk profiles.

- A blend of AI and human analytics to enhance decision-making.

- Strong adherence to regulatory standards ensuring a secure environment.

This is an ideal option for investors seeking diversification and leveraging AI for strategic investments.

Official Website: Rama Vision Investments

2. Dubai Investments Company (DIF)

Best for Diversified Investment Opportunities

With over $320 billion in assets under management, Dubai Investments Company stands as one of the largest independent asset management companies in the UAE. Their diverse portfolio spans sectors such as real estate, infrastructure, healthcare, and blockchain, positioning them as a preferred choice for investors seeking diversified exposure to high-growth industries.

- Key Features:

- Expertise in sustainable and responsible investments.

- A global reach with 17 offices and a team of over 920 professionals.

- Strong foothold in the UAE economy, providing investors with stability and growth opportunities.

For those looking to tap into the UAE’s dynamic growth sectors, Dubai Investments Company offers a robust and diversified portfolio.

Official Website: Dubai Investments Company (DIF)

3. Al Tamimi Investments (ATI)

Best for Social Impact and Financial Returns

Founded in 2006, Al Tamimi Investments focuses on greenfield projects and creating social impact alongside financial growth. Their investments span healthcare, hospitality, and retail, emphasizing innovation and long-term sustainability.

- Key Features:

- Focus on fresh, sustainable ventures.

- Broad spectrum of investment opportunities across diverse sectors.

- Emphasis on creating a tangible social impact.

ATI is ideal for investors who prioritize sustainable investments that align with both financial and social goals.

Official Website: Al Tamimi Investments (ATI)

4. Mubarak & Brothers Investments (MBI)

Best for Real Estate and Sector Diversification

MBI, founded by H.E Saeed Abdul Jalil Al Fahim, is a prominent player in Abu Dhabi’s investment sector. With a focus on real estate, retail, education, and engineering services, MBI aligns with Abu Dhabi’s Vision 2030, contributing to the emirate’s development.

- Key Features:

- Diversified portfolio across key industries.

- Strong revenue performance, reflecting a solid market presence.

- Committed to the growth of Abu Dhabi’s economy.

MBI stands out for investors who want to play a role in the UAE’s strategic growth areas, particularly in real estate and services.

Official Website: Mubarak & Brothers Investments (MBI)

5. Aldar Properties

Best for Property Investment

Aldar Properties, one of the leading asset management companies in the UAE, is synonymous with some of Abu Dhabi’s most iconic real estate developments. In 2023, the company achieved impressive growth, with revenues increasing by 12% year-over-year. Aldar’s robust portfolio spans residential, commercial, and hospitality properties, making it a top choice for property investment in the region.

- Key Features:

- A leading developer in Abu Dhabi’s real estate market.

- Diverse property investment opportunities, including residential and commercial spaces.

- Strong market position with significant EBITDA growth.

For investors seeking real estate investments, Aldar provides access to high-end, lucrative property projects.

Official Website: . Aldar Properties

6. Mubadala Real Estate and Infrastructure

Best for Global Real Estate Exposure

Mubadala’s Real Estate and Infrastructure platform provides investors access to a global portfolio, with a focus on sustainable and innovative real estate projects. Mubadala is part of Abu Dhabi’s sovereign wealth fund, managing over $276 billion in assets, giving investors the confidence of strong financial backing.

- Key Features:

- Investments in digital infrastructure and traditional real estate.

- Focus on sustainability and innovation.

- Global investment outlook, offering international exposure.

For those seeking global real estate opportunities, Mubadala is a top choice.

Official Website: Mubadala Real Estate and Infrastructure

7. BECO Capital

Best for Early-Stage Venture Capital Investments

Dubai-based BECO Capital is recognized as one of the leading asset management companies in the UAE, specializing in venture capital with a focus on early-stage technology companies in the MENA region. BECO has been instrumental in fostering the growth of startups like InstaShop and Kitopi, supporting them in raising billions in capital and scaling their operations across the region.

- Key Features:

- Specializes in tech-driven startups in the MENA region.

- Provides strategic advice and business development support.

- Strong track record of helping companies secure growth capital.

Investors interested in early-stage tech companies will find BECO Capital to be an excellent partner.

Official Website: BECO Capital

8. Wamda Capital

Best for Tech Startups and Long-Term Growth

Wamda Capital, based in Dubai, invests in high-growth tech startups across the MENA region. With a portfolio of over 100 companies, Wamda is committed to supporting entrepreneurs throughout their journey.

- Key Features:

- Diverse investments in sectors like fintech and e-commerce.

- Provides strategic guidance alongside financial backing.

- Focus on innovation and creating impactful businesses.

Wamda is an ideal choice for those looking to invest in the future of technology in the MENA region.

Official Website: Wamda Capital

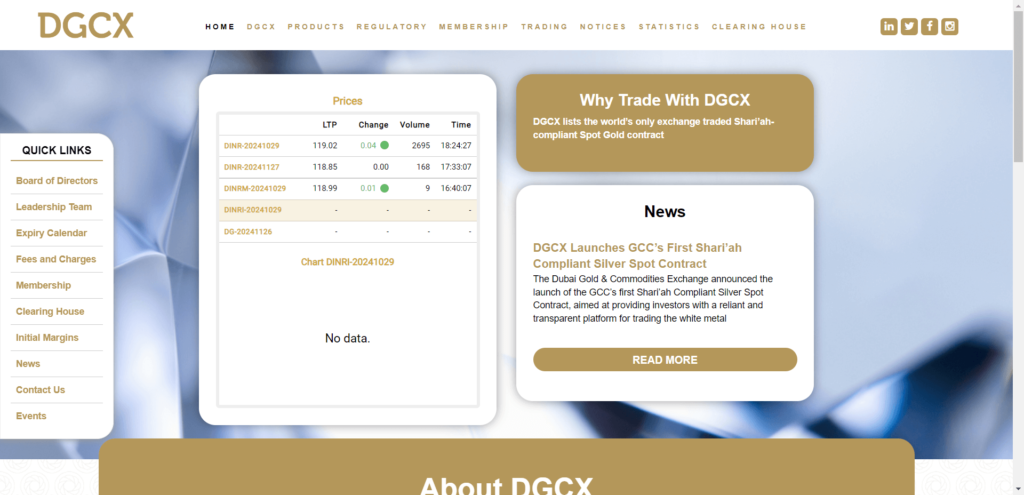

9. Dubai Gold and Commodities Exchange (DGCX)

Best for Commodity Trading

DGCX, the largest derivatives exchange in the Middle East, provides diverse trading opportunities across currencies, hydrocarbons, and metals, catering to a wide range of investors, including Asset Management Companies in the UAE. Known for its innovative offerings, DGCX also pioneers Shari’ah-compliant contracts, further broadening its appeal and supporting varied investment strategies in the region.

- Key Features:

- Extensive product range including G6 currency futures and Indian Rupee Futures.

- The only exchange outside of China licensed to list Shanghai Gold.

- Unique Shari’ah-compliant trading options.

For investors interested in commodities, DGCX is a premier choice for accessing global markets.

Official Website: Dubai Gold and Commodities Exchange (DGCX)

Conclusion

The UAE offers a diverse and vibrant investment landscape, from real estate to cutting-edge AI-driven asset management. Whether you’re looking to invest in high-growth tech startups, property development, or sustainable infrastructure, the UAE’s top asset management companies provide a range of options to suit every portfolio. These asset management companies in the UAE offer tailored solutions, leveraging their expertise to maximize growth and ensure long-term stability in a dynamic mark

Disclaimer:

The list of entities provided here is intended for informational purposes only and does not constitute a recommendation, endorsement, or advice. We make no representations or warranties regarding the accuracy, reliability, or completeness of the information. Readers are strongly encouraged to perform their own research and due diligence before making any decisions related to these organizations. This list is a generic compilation and is not associated with Cosmopolitan The Daily Business Awards or its award winners. We assume no responsibility or liability for any outcomes resulting from actions taken based on this information, including, but not limited to, financial or contractual commitments.