Navigating the banking landscape is essential for both individuals and businesses seeking reliable financial solutions. The Top Banks in India stand out not only for their services but also for their commitment to innovation and customer satisfaction. These banks are instrumental in shaping the country’s financial stability, offering a variety of modern solutions that cater to the evolving needs of the Indian economy.

Whether you’re in search of dependable loans, creative investment opportunities, or seamless digital transactions, the Top Banks in India provide a comprehensive banking experience. Their wide-ranging services, including personalized financial advice, credit facilities, and digital platforms, ensure that customers can manage their finances efficiently and securely. Let’s explore what makes these institutions stand out and how they continue to drive progress in India’s dynamic financial sector.

Defining the Best Banks in India

When evaluating which banks stand at the forefront, several key factors come into play:

- Financial Strength: A bank’s financial performance, including profitability, asset quality, and capital adequacy, is crucial.

- Range of Services: The variety of services, from traditional banking to digital solutions, plays a significant role.

- Customer Service: The responsiveness and accessibility of both digital and in-person customer service channels.

- Digital Capabilities: A user-friendly, technologically advanced interface enhances the overall banking experience.

- Interest Rates: Competitive rates for loans, savings, and other financial products.

- Branch and ATM Network: A wide reach, from urban to rural areas, ensures accessibility.

- Innovative Offerings: Features like digital wallets and personalized financial planning.

- Reputation and Feedback: Client reviews, industry rankings, and overall reputation in the banking sector.

- Community Engagement: A bank’s commitment to sustainability and social responsibility.

Nominate Your Company for the Cosmopolitan The Daily Business Awards!

Does your business deserve global recognition? Nominate now for the Cosmopolitan The Daily Business Awards and celebrate your achievements in innovation, creativity, and impact. This award is open to companies of all sizes and regions, from local innovators to global leaders. Stand out in your industry and showcase your success.

Leading Banks in India

Here’s a closer look at the top banks in India that meet these standards:

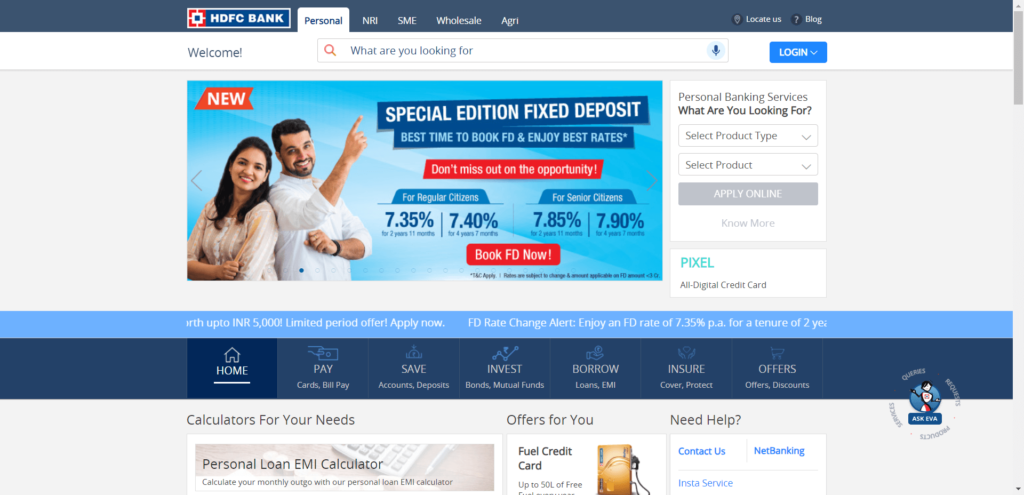

1. HDFC Bank

As the largest private sector bank by market capitalization, HDFC Bank has carved a significant niche in both retail and corporate banking. Offering services from loans to cards and digital banking, it is known for its strong financial performance and customer-first approach.

- Revenue: ₹717.7 billion

- Branches: 8,091

- ATMs: 20,688

- Customer Base: 120 million

- Gross NPA: 1.26%

Official Website: HDFC Bank

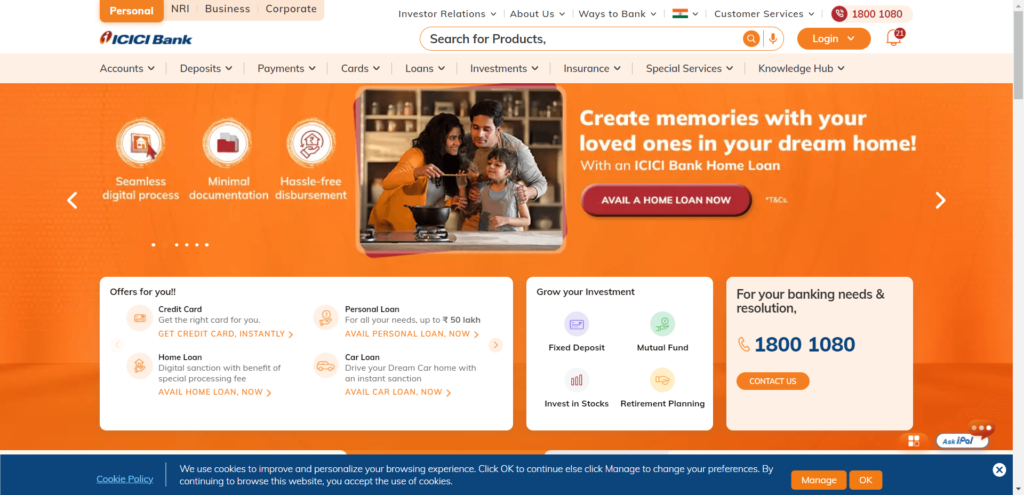

2. ICICI Bank

ICICI Bank is a multinational financial services leader, known for its wide range of offerings, including personal, corporate, and international banking. Its focus on technology and green financing further strengthens its position in the banking industry.

- Revenue: ₹14,601 crore

- Branches: 6,371

- Customer Base: Over 5.5 million

- Gross NPA: 2.30%

Official Website: ICICI Bank

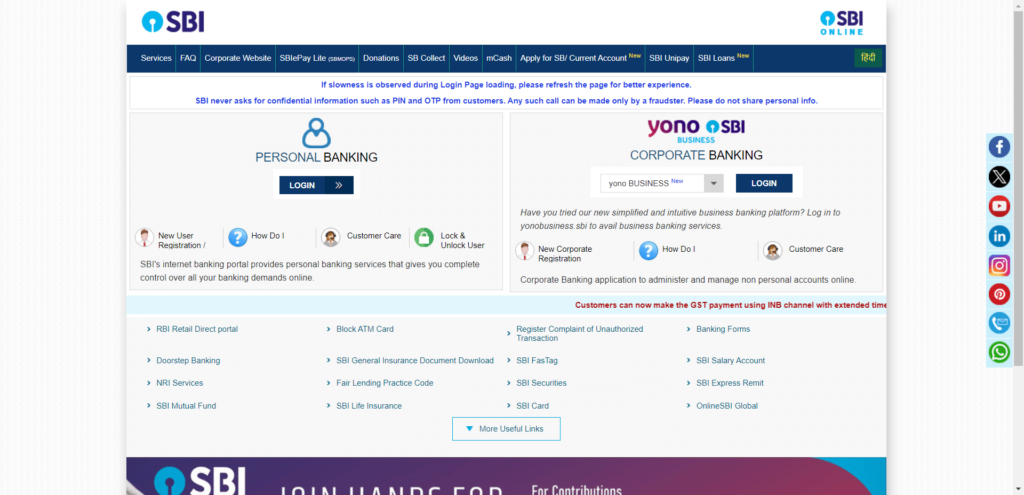

3. State Bank of India (SBI)

SBI is India’s largest public sector bank, offering comprehensive services across retail and corporate banking, including loans, cards, and investments. It has an unmatched network of branches and ATMs, both in India and globally.

- Revenue: ₹50,232 crore

- Branches: 22,405

- ATMs: 65,627

- Customer Base: 480 million

- Gross NPA: 2.78%

Official Website: State Bank of India (SBI)

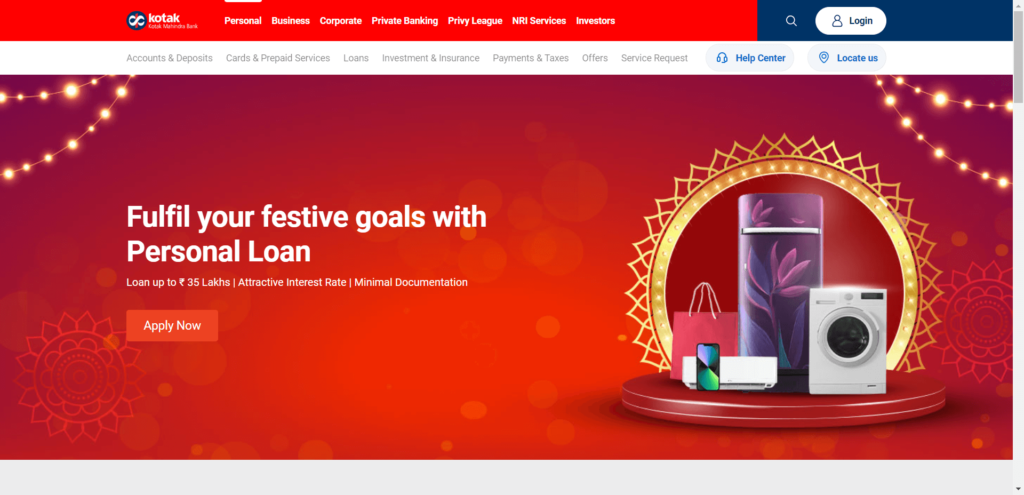

4. Kotak Mahindra Bank

Kotak Mahindra Bank is known for its competitive interest rates on loans and high savings interest rates. The bank provides a range of services from wealth management to insurance, appealing to both corporate and retail customers.

- Revenue: ₹67,981 crore

- Branches: 1,780

- Gross NPA: 0.37%

- Customer Base: 41.2 million

Official Website: Kotak Mahindra Bank

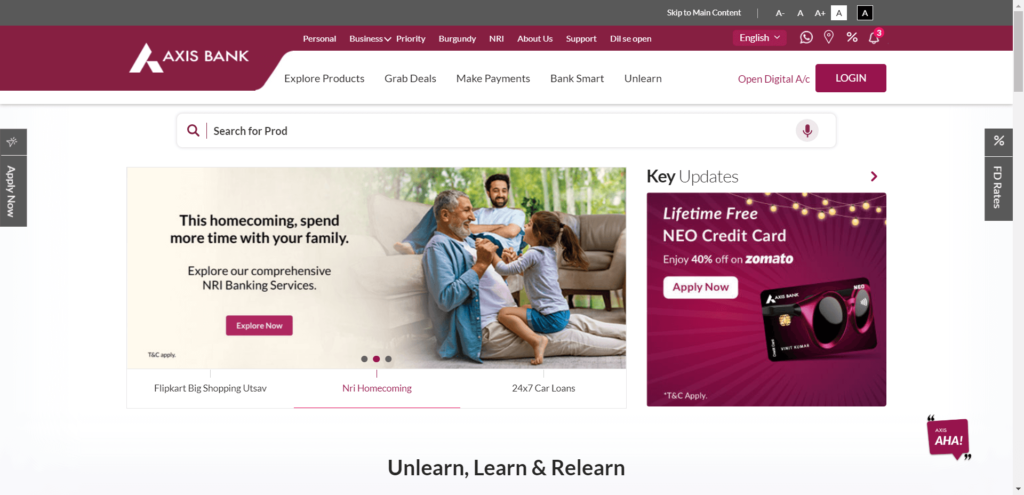

5. Axis Bank

Axis Bank, the third-largest private sector bank in India, offers a broad spectrum of services, from corporate banking to retail banking and digital services. It is known for its focus on customer service and digital innovation.

- Revenue: ₹106,155 crore

- Branches: 4,903

- Customer Base: 20 million

- Gross NPA: 1.58%

Official Website: Axis Bank

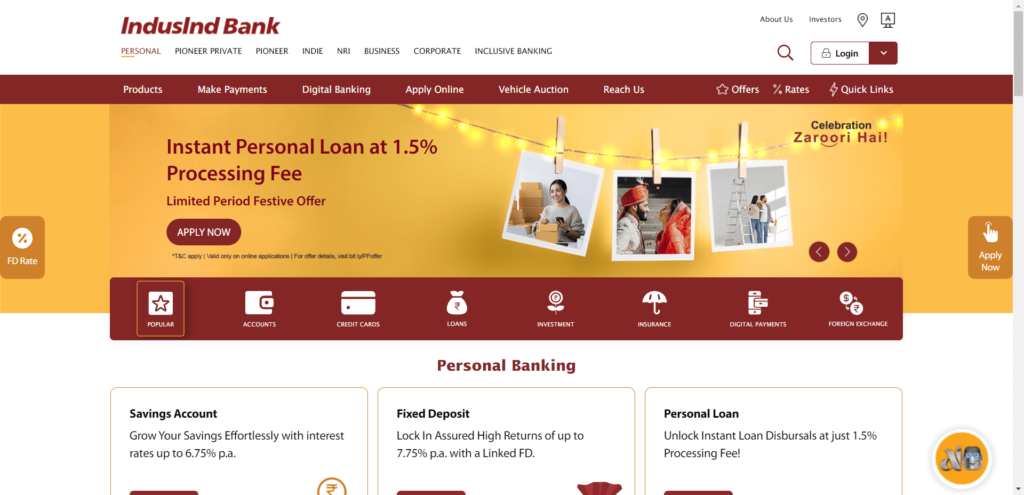

6. IndusInd Bank

IndusInd Bank is a new-generation private sector bank, recognized among the Top Banks in India, with a strong focus on providing personalized financial solutions. Its extensive product portfolio includes personal, corporate, and international banking services, catering to the diverse needs of its customers across India.

- Revenue: ₹44,540 crore

- Branches: 2,728

- Customer Base: 33 million

- Gross NPA: 1.92%

Official Website: IndusInd Bank

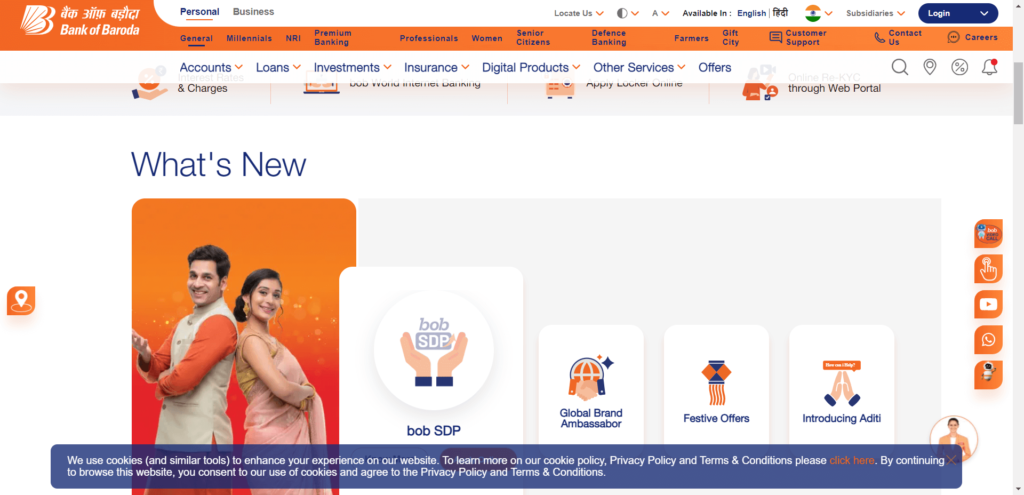

7. Bank of Baroda

As one of the Top Banks in India, Bank of Baroda is the second-largest public sector bank in the country, with an extensive branch network both domestically and internationally. It offers a wide range of financial services, including loans, investments, and cards, catering to diverse customer needs across various sectors.

- Revenue: ₹110,777 crore

- Branches: 9,693

- Customer Base: 153 million

- Gross NPA: 3.79%

Official Website: Bank of Baroda

8. Punjab National Bank (PNB)

One of the oldest and Top Banks in India, PNB continues to be a major player in the public sector, offering everything from personal banking to corporate and international services. Its long-standing legacy and comprehensive range of financial solutions make it a key institution in the country’s banking landscape.

- Revenue: ₹99,084 crore

- Branches: 12,609

- Customer Base: 180 million

- Gross NPA: 8.74%

Official Website: Punjab National Bank (PNB)

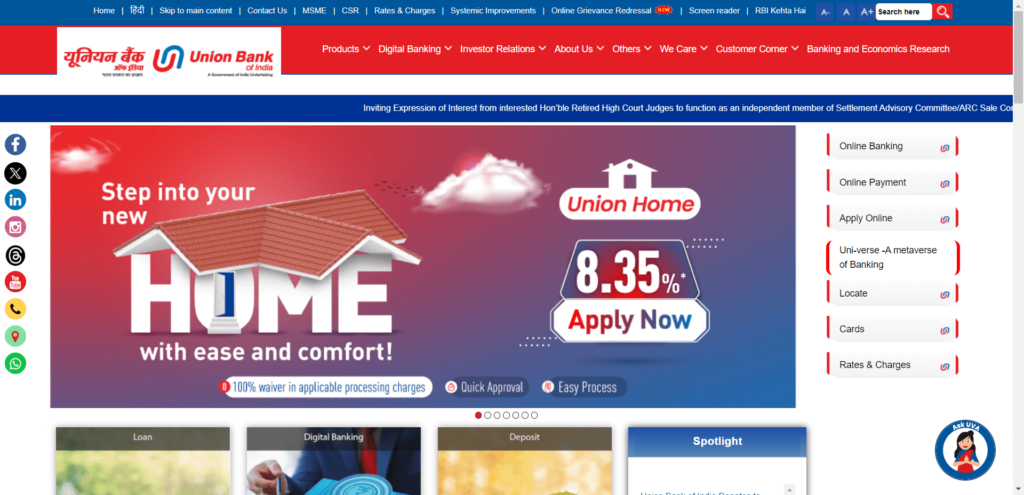

9. Union Bank of India

Union Bank of India, one of the Top Banks in India, is a prominent government-owned financial institution known for its comprehensive range of banking services. With a strong presence across both rural and urban areas, it plays a significant role in catering to the diverse financial needs of individuals, businesses, and government sectors.

- Revenue: ₹97,078 crore

- Branches: 8,561

- Customer Base: 153 million

- Gross NPA: 7.34%

Official Website: Union Bank of India

10. Canara Bank

Founded in 1906, Canara Bank is one of the Top Banks in India, known for its wide range of banking and financial products. As a public sector bank, Canara Bank has a strong focus on modernizing its services to meet the evolving needs of its diverse customer base across the country. With a legacy of trust and reliability, it continues to be a key player in the Indian banking sector.

- Revenue: ₹3,656 crore

- Branches: 9,518

- Customer Base: 111.9 million

- Gross NPA: 4.39%

Official Website: Canara Bank

Conclusion

The Top Banks in India continue to be pillars of strength in the financial sector. These institutions excel in providing innovative solutions, seamless customer service, and robust financial products, ensuring their critical role in the nation’s economic growth. Whether you are an investor, a borrower, or simply looking for reliable banking services, these Top Banks in India offer the stability, trust, and technology that meet modern banking needs. With a focus on customer satisfaction and technological advancements, they remain essential players in shaping the future of the Indian banking landscape.

Disclaimer:

The list of entities provided here is intended for informational purposes only and does not constitute a recommendation, endorsement, or advice. We make no representations or warranties regarding the accuracy, reliability, or completeness of the information. Readers are strongly encouraged to perform their own research and due diligence before making any decisions related to these organizations. This list is a generic compilation and is not associated with Cosmopolitan The Daily Business Awards or its award winners. We assume no responsibility or liability for any outcomes resulting from actions taken based on this information, including, but not limited to, financial or contractual commitments.