Egypt has rapidly emerged as a leading hub in the Middle East’s fintech landscape, with Forbes Middle East‘s 2024 Fintech 50 list highlighting the Top 10 Fintech Companies in Egypt. These companies are revolutionizing financial services in the region, spanning digital payments, open banking, investment apps, and lending services. Here’s an overview of the Fintech Companies in Egypt reshaping the industry.

Nominate Your Company for the Cosmopolitan The Daily Business Awards!

Does your business deserve global recognition? Nominate now for the Cosmopolitan The Daily Business Awards and celebrate your achievements in innovation, creativity, and impact. This award is open to companies of all sizes and regions, from local innovators to global leaders. Stand out in your industry and showcase your success.

Top Fintech Companies in Egypt

1. Fawry

Founded in 2008, Fawry is a premier e-payment platform in Egypt. It serves both banked and unbanked populations, offering electronic bill payments, mobile top-ups, and various digital services such as e-ticketing and cable TV payments. Fawry processes over 5 million transactions daily and has a customer base of approximately 51.7 million users monthly. In 2023, Fawry’s revenue surged to EGP 2.3 billion (US$48 million), with a net income of EGP 715.3 million (US$15 million).

Official Website: Fawry

2. MNT-Halan

MNT-Halan is a fintech ecosystem established in 2018, targeting the unbanked and underbanked segments in Egypt. The company offers a wide range of services including MSME lending, payments, consumer finance, BNPL, and e-commerce. MNT-Halan has served over 5 million customers and processes US$100 million in transactions monthly. In 2023, it raised US$400 million, bringing its valuation to over US$1 billion.

Official Website: MNT Halan – DIGITALLY BANKING the unbanked (mnt-halan.com)

3.AMAN Group

AMAN Group, a subsidiary of Raya Holding, is a key player in Egypt’s fintech sector. It consists of AMAN Financial Services, AMAN Microfinance, and AMAN E-Payments, providing a wide range of financial services. AMAN Group reported revenues of EGP 4.6 billion (US$96 million) in 2023. The AMAN SuperApp, integrating various services, has seen over 1.8 million downloads.

Official Website: Aman Group

4. Valu

Valu offers lifestyle-enabling financial solutions, including BNPL services with customizable financing plans. The platform, available at over 5,000 POSs and 600 websites, also provides investment products and savings solutions. Valu recently partnered with Visa to launch a prepaid card, expanding its offerings in the market.

Official Website: Valu

5. Thndr Securities Brokerage

Thndr Securities Brokerage provides a digital investment platform for trading Egyptian and US stocks. Launched in 2020, it quickly captured over 21.5% of trades on the Egyptian Exchange (EGX) and amassed over 800,000 users. Thndr also offers investment research services through its brand, Rumble.

Official Website: Thndr

6. Paymob

Established in 2015, Paymob is a leading payment services provider in the MENAP region. It offers over 40 payment solutions to more than 250,000 merchants. Paymob has partnered with Mastercard to promote low-cost digital payment solutions and has expanded into markets like Pakistan, UAE, and Saudi Arabia.

Official Website: Paymob

7. Contact Financial Holding

Contact Financial Holding is a prominent provider of finance solutions in Egypt. The company offers consumer and corporate finance products, including auto credit and insurance. It operates through 76 locations and over 10,000 POSs nationwide, playing a crucial role in Egypt’s debt capital markets.

Official Website: Contact Financial Holding – Investor Relations

8. Paysky

Paysky is a payment solutions provider operating in 18 countries across the Middle East, Africa, and Asia. The company serves over 250 financial institutions and aims to democratize e-payments, targeting one billion consumers and one million businesses within the next decade.

Official Website: Paysky Digital Payment Solutions Egypt.

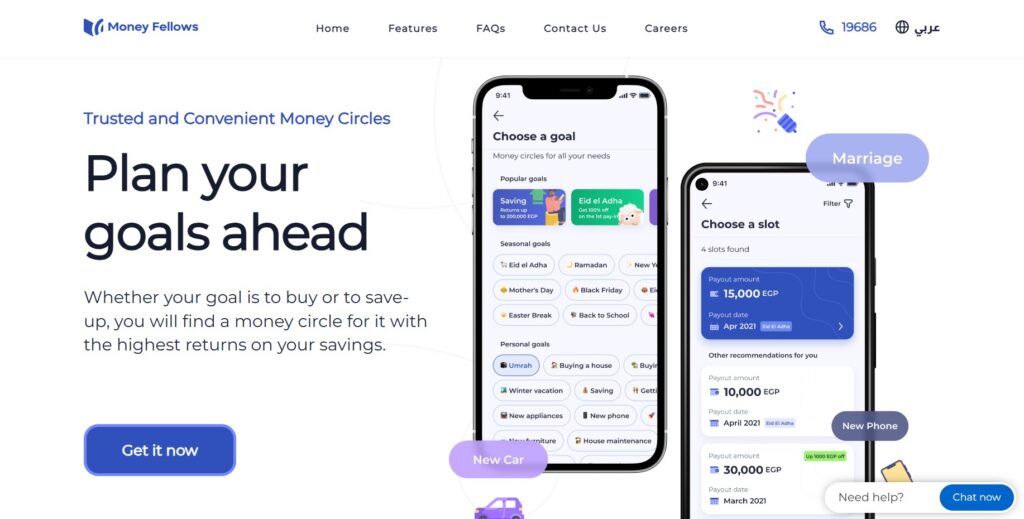

9. Money Fellows

Money Fellows digitizes the traditional rotating savings and credit association (ROSCA) model. Launched in 2017, it has over 4.5 million users and has raised US$50 million in funding. The platform enhances accessibility, transparency, and inclusivity of money circles.

Official Website: Money Fellows

10. Telda

Telda, founded in 2022, is a money app designed for Millennials and Gen Z. It allows users to open a free account and get a card for global transactions. Telda secured US$20 million in seed funding and is poised for market expansion and product enhancement.

Official Website: Telda – The easiest way to send, spend and save money

Conclusion

Egypt’s fintech sector is thriving, driven by innovation and robust growth. As the Top 10 Fintech Companies in Egypt continue to lead the charge, companies like Fawry, MNT-Halan, and AMAN Holding are at the forefront, offering diverse financial solutions that cater to various market needs. These fintech companies in Egypt are not only expanding their services but also evolving to meet the dynamic demands of the industry. As they continue to innovate, Egypt’s position as a fintech powerhouse in the Middle East is set to strengthen further.

Disclaimer:

The list of entities provided here is intended for informational purposes only and does not constitute a recommendation, endorsement, or advice. We make no representations or warranties regarding the accuracy, reliability, or completeness of the information. Readers are strongly encouraged to perform their own research and due diligence before making any decisions related to these organizations. This list is a generic compilation and is not associated with Cosmopolitan The Daily Business Awards or its award winners. We assume no responsibility or liability for any outcomes resulting from actions taken based on this information, including, but not limited to, financial or contractual commitments.