Insurance companies play a crucial role in providing financial security against unforeseen risks. In Dubai, a thriving hub of commerce and lifestyle diversity, choosing the right insurance provider requires careful consideration of coverage, reliability, and customer service. To help you navigate this landscape, we’ve compiled a curated list of the Top 10 Insurance Companies in Dubai. These insurance companies in Dubai are recognized for their comprehensive coverage options, excellent customer service, and overall reliability. Discover the top insurance companies in Dubai that can provide the protection and peace of mind you need.

Nominate Your Company for the Cosmopolitan The Daily Business Awards!

Does your business deserve global recognition? Nominate now for the Cosmopolitan The Daily Business Awards and celebrate your achievements in innovation, creativity, and impact. This award is open to companies of all sizes and regions, from local innovators to global leaders. Stand out in your industry and showcase your success.

Best Insurance Companies in Dubai

1. Abu Dhabi National Insurance Company (ADNIC)

Established in 1972, ADNIC offers a comprehensive range of insurance products including health, car, home, and travel insurance. With a strong financial stability rating from AM Best and recognition for digital innovation, ADNIC ensures robust protection for individuals and businesses alike.

Official Website: ADNIC – Insurance Company in Dubai, Abu Dhabi, Sharjah & UAE – Abu Dhabi National Insurance Company

2. Abu Dhabi National Takaful Company (ADNTC)

As a leader in Takaful insurance since 2003, ADNTC specializes in Sharia-compliant insurance solutions. Recognized for its ethical approach and strong financial backing, ADNTC provides various products such as motor vehicle and workmen’s compensation Takaful insurance.

Official Website: Abu Dhabi National Takaful Co. PSC

3. MetLife Gulf

With over 65 years of experience in the Gulf region, MetLife Gulf offers a range of investment and protection solutions. Their offerings include savings plans, accident insurance, and specialized solutions tailored for corporate clients, backed by stellar customer service and innovative product offerings.

Official Website: metlife-gulf.com

4. GIG Gulf (formerly AXA Insurance Gulf Dubai)

A prominent insurer licensed by the UAE Insurance Authority, GIG Gulf provides extensive coverage including health, travel, car, and home insurance. With a reputation for efficiency in claims processing and customer service excellence, GIG Gulf remains a preferred choice for many.

Official Website: GIG Insurance.

5. Dubai Insurance Company

Established under royal decree in 1970, Dubai Insurance Company is renowned for its diverse insurance portfolio covering property, liability, marine, and medical insurance. With a long-standing ‘Excellent’ rating from AM Best, they emphasize tailored solutions and global reinsurance partnerships.

Official Website: Dubai Insurance (dubins.ae)

6. Noor Takaful Insurance

Founded in 2009, Noor Takaful Insurance is a pioneer in ethical insurance solutions in the UAE. Named ‘Insurance Brand of the Year’ and offering localized services with a focus on customer-centricity, Noor Takaful is ideal for those seeking comprehensive and culturally sensitive coverage.

Official Website: Noor Takaful – Lifecare International Insurance

7. National General Insurance Company (NGI)

Since 1980, NGI has been a trusted name in the UAE insurance market, offering a wide array of insurance products including motor, medical, and commercial insurance. With a commitment to high claim satisfaction and transparency, NGI ensures peace of mind for its policyholders.

Official Website: Best Insurance Company in Dubai | Buy Insurance Policy Online (ngi.ae)

8. Oman Insurance Company (Bupa)

One of the oldest insurers in the UAE, Oman Insurance Company has been serving customers since 1975. They provide specialized insurance solutions including life, health, and general insurance with a focus on rapid claims processing and customer satisfaction.

Official Website: Bupa Group – corporate news and financials | Bupa Group

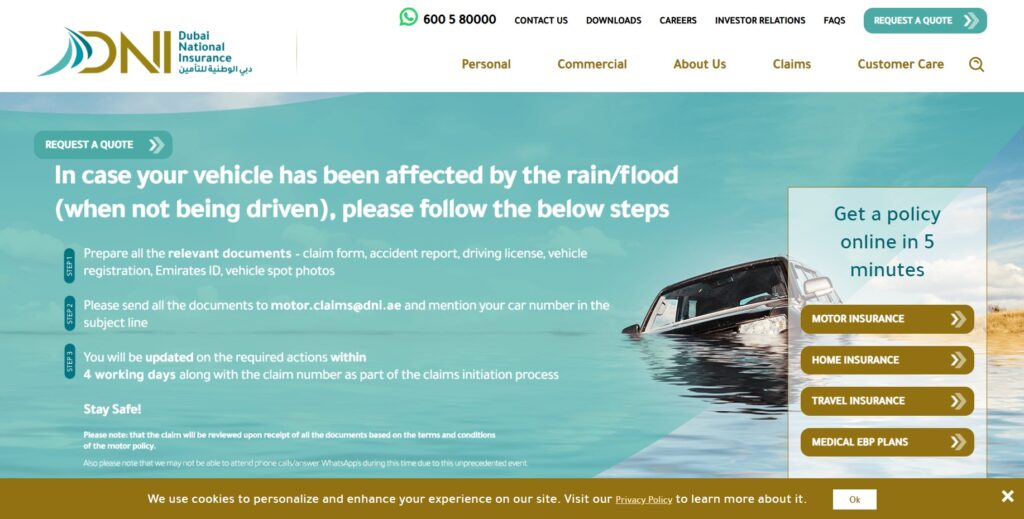

9. Dubai National Insurance & Reinsurance (DNIR)

Established in 1992, DNIR is known for its comprehensive range of insurance solutions including motor, medical, and commercial insurance. With strong partnerships with international reinsurers, DNIR offers reliable coverage and exceptional customer service.

Official Website: One of the Best Insurance Companies in Dubai (dni.ae)

10. Alliance Insurance

Operating since 1975, Alliance Insurance is recognized for its longevity and commitment to customer service. They offer a wide range of insurance products including health, life, property, and marine insurance, with a reputation for customer-first policies and technological innovation.

Official Website: Alliance Insurance (alliance-uae.com)

Conclusion

Choosing the right insurance company in Dubai is essential for protecting your personal and business interests. Whether you require health coverage, vehicle protection, or comprehensive commercial insurance, these Top 10 Insurance Companies in Dubai for 2024 offer reliable solutions backed by strong financial stability, customer service excellence, and a wide range of tailored products. When searching for the best options among insurance companies in Dubai, be sure to evaluate their offerings to find the best match for your needs. Consider these top insurance companies in Dubai to ensure you make an informed and effective choice for your insurance requirements.

Disclaimer:

The list of entities provided here is intended for informational purposes only and does not constitute a recommendation, endorsement, or advice. We make no representations or warranties regarding the accuracy, reliability, or completeness of the information. Readers are strongly encouraged to perform their own research and due diligence before making any decisions related to these organizations. This list is a generic compilation and is not associated with Cosmopolitan The Daily Business Awards or its award winners. We assume no responsibility or liability for any outcomes resulting from actions taken based on this information, including, but not limited to, financial or contractual commitments.